This is a scary topic for many people since many don’t know where to start, but before we get into how to create a budget and make it a part of your financial planning let’s first understand why it is necessary by addressing the Who, What, Where, When, Why and most importantly How to create and manage a Budget.

WHO… should budget?

Everybody. Absolutely everybody. Whether you’re just starting out or you have Scrooge McDuck kind of money, a budget should be the foundation of everyone’s financial plan. It is important for anyone who is trying to advance their personal finance goals to get a good grip on where their money is coming from and where it is going.

WHAT… is a budget?

A budget is simply a framework that allows you to gain complete clarity over your spending habits and your income. A budget acts as a benchmark that you can use to determine whether you are on track to meet your goals or whether your plan needs to adjust (Yes, a budget can change!). A budget resembles a pie the represents your income and that pie needs to be divided into life categories. Budgets are typically set for each month of the year since there is a very definitive start and end to a period and it is not too small to be annoying but also not too big to become daunting.

WHERE… should budgets be managed?

This is a more fluid topic and honestly depends on personal preference. It can be done in a notebook, excel or using sophisticated online tools but at the end of the day where you maintain your budget needs to be somewhere that you will continuously keep it up to date. If it is too manual it may be too cumbersome and it won’t get done and on the other hand if it is too automatic it may never be looked at. I will share some tools that I use in the “How to Create and Manage a Budget”.

WHEN… should you budget?

When you should set a budget (ie set your spending and saving expectations for each life category) and when you should manage your budget (ie tracking your actual spending against these life categories) may not happen at the same time. It is helpful to setup a yearly budget at the end of every year for the upcoming year and adjust if there are known upcoming expenses (ie a renovation, a destination wedding, loans coming due etc) as well as expected incomes (ie tax returns, bonuses etc) in the respective months. Of course things will come up during the year that will impact your budget, perhaps a sibling gets engaged or you decide to go back to school and your budget must be updated to reflect these new life categories. As long as your income pie < life categories pie then you are in budget-balance.

Tracking your spending against your budget in specific interval allows you to get into the habit. I track my husband and I’s transactions against our budget on the 1st and 15th of each month. This isn’t set in stone but it keeps us in a nice rhythm and we can identify if a month is getting away from us or if we are doing really well!

Why… should you budget?

In order to meet any long term goal it is important to put a plan in place, whether it is running a marathon (much harder than budgeting), getting a degree (or 2, or 3…) or some financial goal it is imperative to have a plan in order to determine your progress throughout your journey. The level of detail on a plan is typically correlated to the time period in which you are trying to reach your goal. For example if you plan on retiring in 20 years the overall 20 year plan will be at a much higher level than the first year plan.

It behaves very much like a Russian nesting doll short term > medium term > long term

Short Term

Detailed monthly tracking to see what life categories are in check and which ones may need to be reviewed

Medium Term

A summarized view of the monthly categories to gauge higher level progress

Long Term

Summarized view of your medium term goals/tracking to analyse your current and past spending to see if you’re trending in the right direction to meet your financial goals!

These views are the very reason why we set and track a budget. It allows you to hold yourself accountable to your goals in an unemotional and 100% fact driven way.

Now that we have a good foundation of the core understanding of budgets let’s look at the actual practicality of How to Create and Manage a Budget.

How… to Budget

There are a few interesting frameworks for how to create a budget.

50/30/20 Rule

One of the most popular is the 50/30/20 rule ,made famous by Elizabeth Warren, that stipulates you spend 50% of your after-tax income on needs, 30% on wants and 20% on savings. This is perhaps a good starting point but not nearly detailed enough to stay on track.

If you took home $5,000.00 a month $2,500 should be dedicated to your needs, $1,500 should be spent on wants and the remaining $1000.00 should be put towards your savings. The two faults I find in the level of budgeting is:

- There is a minimal cost to being able to live a comfortable life. I don’t mean an apartment with a 24/7 concierge and a charge port for your Tesla. I mean living in a safe neighborhood and being able to afford healthy groceries. That base cost varies depending on where you live and the remaining costs don’t always remain relative.

- The subjectivity of want vs need provides a lot of room for excusing bad spending. Yes you need somewhere to live, but no you don’t need it to be right on the subway line and the cost difference can be thousands of dollars a year. Let’s say that the apartment close to the subway is $1,750.00 a month for rent but the one further away is $1,300.00 you can argue that putting the $1,300.00 against the need budget and the remaining $450.00 against the want because of convenience. This to me is overly cumbersome and very hard to justify. You end up spending more time working around the budgets framework rather than managing the budgets and that is not where the focus should be.

Zero-based or bottom-up budgeting

The other side of this coin is a zero-cost budgeting approach that requires justifying each life categories budget for each period from the bottom up. Traditional budgeting often relies on previous budgets and just grossing up historical budget by a percentage “because life gets more expensive”. It is more intensive to budget this way but it forces you to have your finger on the pulse of your spending and helps you adjust long before there is a true financial problem in your household. This approach is applied to each period in your budget for each life category.

For example setting a budget for January and February may look similar in some categories but can be flexible to be different based on the circumstances of the month. January has a weekend getaway planned that needs to be budgeted for where February has a wedding that will require more money for gifts. January is a typical salaried month but February includes a bonus payment of $1500 that boosts your savings:

| Jan | Feb | |

| Income | $ 5,000.00 | $ 6,500.00 |

| Food | $ 800.00 | $ 800.00 |

| Home | $ 2,200.00 | $ 2,000.00 |

| Personal | $ 300.00 | $ 500.00 |

| Transportation | $ 500.00 | $ 500.00 |

| Vacation | $ 300.00 | $ |

| Entertainment | $ 300.00 | $ 500.00 |

| Gifts | $ 100.00 | $ 300.00 |

| Saving | $ 500.00 | $ 1,900.00 |

Fundamentally the bottom up budgeting is significantly more accurate and manageable.

My Budget

It has taken a few years to refine the way I budget for each period in the year. Typically I spend the end of each year establishing a bottom up or zero-based budget for each month of the upcoming year. At the end of 2019 i took stock of what was the collective budget for the year vs the collective spend and the variance came within 1.6%. Don’t get me wrong the budget was adjusted throughout the year as new things happened (ie my sister got engaged, my brother-in-law had their second kid, friends got married etc) but they all were added to the budget as we knew they were going to require some financial commitment from us. This is the process I follow:

Household Income

Often people start with their expenses and then try to determine what they need to earn to cover the life they have budgeted for. Being a realist that seems like a particularly doe-eyed way of approaching finances instead of “this is what I have to work with” approach. It is important to capture your after-tax income each month as accurately as possible. Secondly you should account for any bonuses, commissions and tax returns in the respective months that you anticipate receiving them. To be conservative I always take the expected amount and multiply it by 80% so that I provide myself with some buffer/contingency in the event the full amount does not result for whatever reason.

Essential Expenses

These are the expenses that will be present every single month regardless of what is happening. These might vary from person to person but is pretty consistent for most people. It is important to really understand these expenses since they are mainly static and not very flexible you must ensure that they can be covered each month, every month. An enormous amount of stress is generated when the essentials cannot be covered, so do yourself a favor and eliminate this unnecessary stress. They include but are not limited to:

- Housing costs (rent, utilities, internet, insurance)

- Transportation (car payments, gas, insurance, transit)

- Food (groceries, restaurants, coffee)

- Personal (Health, clothes, insurance)

- Debt (student loans, lines of credit )

- Savings

Non-essential expenses

These are expenses that are present for most people but they can vary greatly on what are the higher spending months vs the lower spending months. These are variable and fluctuate greatly each month

- Entertainment (events, tickets, subscriptions)

- Vacation (flights hotels, restaurants, events, tickets)

- Gifts (holidays, birthdays, weddings, just feeling generous?)

- Personal (hobbies, beauty)

Unusual expenses

Each year has a few events that are not like prior years. For example my sister got married last year and I was fortunate enough to be her maid-of-honour. I knew that I would have additional expenses for her bridal shower, bachelortte party and gifts. These events can be stressful if you don’t plan for them because costs seem to be never ending (and always more expensive that you thought they’d be). Once you plan for them and you know what you are working with it is much easier to manage

Income vs Expenses and goal setting

Now that you know what your income for each period is and what your intended expenses are you can start working out some of the discrepancies. It is important to identify where monthly expenses > monthly income or your monthly income > monthly expenses. The goal is to be in budget balance. The months where your income is going to be greater than your expenses may be the months you use to prop up your emergency fund. The months where your income is less than your planned expenses are the months where you need to take stock on what you can cut out (maybe eat out less, say no to a bar night or two, take public transit over the all convenient Uber/Lyft options).

This part of creating your budget can also help you determine whether some life categories are out of whack. Here is a guideline roughly speaking how much each of your categories take up your expected income:

| Category | Lower Band | Upper Band |

|---|---|---|

| Food | 10% | 15% |

| Home | 25% | 40% |

| Personal | 15% | 25% |

| Transport | 10% | 15% |

| Vacation | 0% | 10% |

| Entertainment | 5% | 10% |

| Gifts | 5% | 5% |

| Savings | 10% | 25% |

| Debt | 0% | 15% |

The guidelines are helpful as a starting point but as you budget more frequently these percentages can change dramatically. I started out with a similar guideline but after a while I was able to narrow down where we actually spend our money and budgeted accordingly. We kept our savings/investments top of mind and figured as long as everything else was covered without going into debt it was fine. We’ve made some sacrifices regarding where we live to minimizing our fixed costs and only having one car. For that reason we are able to save about 20-50% of our after tax income in a month.

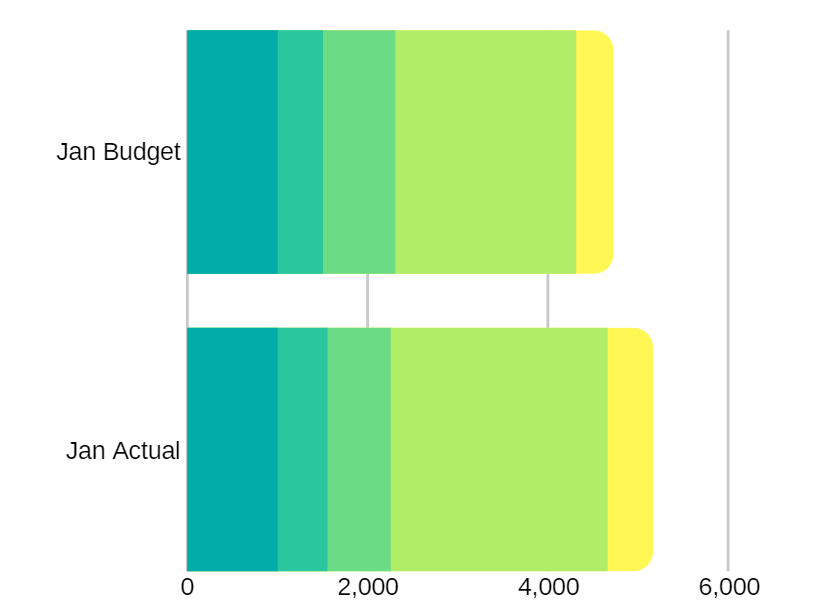

Here is an example of the our January 2019 budget, actual’s and the percentages of our monthly take home pay:

| Category | % | Budget | Actual |

| Income | 100% | $ 13,773.34 | $ 13,342.01 |

| Food | 12% | $ 1,700.00 | $ 2,213.80 |

| Home | 16% | $ 2,250.00 | $ 2,130.14 |

| Personal | 10% | $ 1,325.00 | $ 1,601.59 |

| Transport | 5% | $ 700.00 | $ 890.23 |

| Vacation | 16% | $ 2,148.63 | $ 2,586.33 |

| Entertain. | 9% | $ 1,300.00 | $ 940.53 |

| Gifts | 7% | $ 1,000.00 | $ 779.05 |

| Investment | 24% | $ 3,305.60 | $ 2,200.34 |